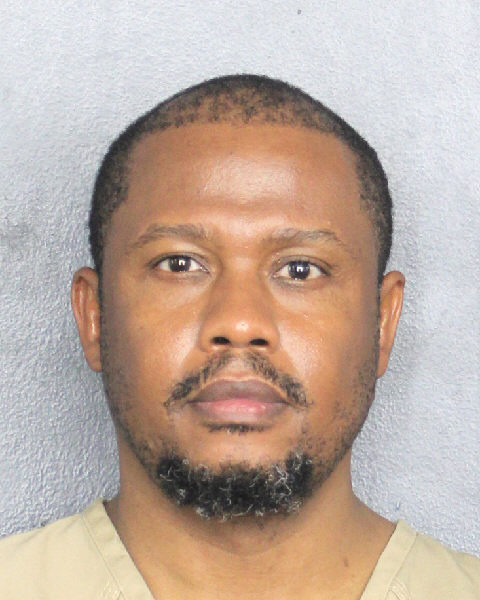

SEC Charges Marc Henry Menard in $1.65 Million Fraud Scheme Targeting Haitian-American Investors

Washington, D.C., August 2025 – The U.S. Securities and Exchange Commission (SEC) has filed charges against Marc Henry Menard, alleging that he defrauded more than 50 investors — most of them Haitian-Americans — in an investment scheme that raised at least $1.65 million between July 2021 and September 2023.

Promises of High Monthly Returns

According to the SEC’s complaint, Menard enticed victims with promises of extraordinary monthly profits, claiming that his trading strategy in stocks and options could generate 10% to 20% returns every month. These claims, however, were false and misleading.

Investigators found that Menard actually lost nearly $700,000 in trading activities. Rather than being transparent with investors, he concealed the losses and continued to solicit funds with false assurances of success.

Lavish Spending of Investor Funds

The SEC alleges that Menard used significant portions of investor money for personal expenses rather than for legitimate trading. These expenditures included:

- Luxury vehicles, including Mercedes-Benz and BMW cars

- High-end designer goods, such as Louis Vuitton and Gucci merchandise

- Expensive international travel across multiple countries

- Gifts and personal indulgences unrelated to any investment activity

Authorities further allege that Menard transferred large sums of money to Laesha Jean-Louis, described in court documents as a woman with whom he was in a romantic relationship.

Ponzi-Like Payments

The SEC also accuses Menard of operating his scheme in a fashion similar to a Ponzi scheme, in which funds from new investors were used to pay earlier investors. This tactic gave the illusion of profitability and sustained the fraud for more than two years.

Legal Action and Potential Penalties

Menard now faces multiple charges of violating U.S. federal anti-fraud securities laws. The SEC is seeking:

- A permanent injunction barring him from future securities law violations

- Full disgorgement of all ill-gotten gains plus interest

- Civil penalties for his fraudulent conduct

- A permanent ban prohibiting him from serving as an officer or director of any public company

The case is being handled under SEC Litigation Release No. 26019.

Community Impact

The allegations carry significant weight within the Haitian-American community, where trust-based investment networks are often relied upon. For many of Menard’s victims, the losses represent years of savings and hard-earned income.

Financial watchdogs emphasize that the case serves as a stark reminder for investors to exercise caution, especially when presented with promises of unusually high returns.

Conclusion

The SEC’s action against Marc Henry Menard highlights the ongoing risks of financial fraud targeting immigrant and minority communities. As the legal process unfolds, victims await restitution, while regulators stress the importance of vigilance and transparency in protecting vulnerable investors.

If found liable, Menard faces not only financial penalties but also permanent exclusion from positions of corporate trust — marking a dramatic fall for someone who once claimed to offer wealth-building opportunities.